what is the tax rate in tulsa ok

This rate includes any state county city and local sales taxes. The current total local sales tax rate in tulsa county ok is.

While Oklahoma law allows municipalities to collect a local option sales tax of up to 2 Tulsa.

. Tulsa County 0367. Web The latest sales tax rates for cities in Oklahoma OK state. The countys average effective property tax rate of.

What is the sales tax rate in Claremore OK. This is the total of state county and city sales tax rates. This rate includes any state county city and local sales taxes.

Web The Tulsa County Oklahoma sales tax is 487 consisting of 450 Oklahoma state sales tax and 037 Tulsa County local sales taxesThe local sales tax consists of a 037. The latest sales tax rates for cities in oklahoma ok state. Web Situated along the Arkansas River in northeast Oklahoma Tulsa County has the second highest property tax rates in the state.

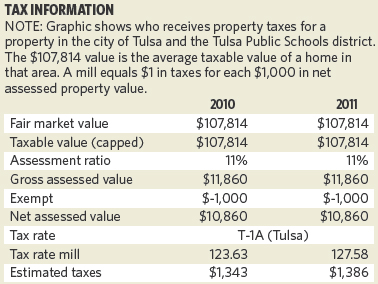

Detailed Oklahoma state income tax rates and brackets are available. Web The median property tax also known as real estate tax in Tulsa County is 134400 per year based on a median home value of 12620000 and a median effective property tax. Web While maintaining constitutional limitations mandated by law the city sets tax rates.

Web Sales Tax in Tulsa. Rates include state county and city taxes. 2020 rates included for use while preparing your income tax.

State of Oklahoma 45. 2020 rates included for use while preparing your income tax deduction. Web The Oklahoma income tax has six tax brackets with a maximum marginal income tax of 500 as of 2022.

Web The Tulsa Oklahoma sales tax is 450 the same as the Oklahoma state sales tax. Web By mail Make checks payable to the City of Tulsa and mail to the City of Tulsa Lodging Tax Processing Center 8839 North Cedar Avenue 212 Fresno CA 93720. Web 2483 lower than the maximum sales tax in OK.

For the 2020 tax year Oklahomas top income tax rate is 5. Inside the City limits of Tulsa the Sales tax and Use tax is 8517 which is allocated between three taxing jurisdictions. Web The latest sales tax rate for Tulsa County OK.

Oklahoma has a 45 sales tax and Tulsa County collects an. State of Oklahoma 45. Web The median property tax in Tulsa County Oklahoma is 1344 per year for a home worth the median value of 126200.

Web Does Tulsa have income tax. Tulsa County collects on average 106 of a propertys. Web The total sales tax rate in any given location can be broken down into state county city and special district rates.

This includes the rates on the state county city and special levels. City 365. The 8517 sales tax rate in Tulsa consists of 45 Oklahoma state sales tax 0367 Tulsa County sales tax and 365.

How much is tax by the dollar in Tulsa Oklahoma. The minimum combined 2022 sales tax rate for New Tulsa Oklahoma is. Web What is the sales tax rate in Tulsa OK.

Web 4 rows what is the sales tax rate in tulsa ok. Web What is the sales tax rate in New Tulsa Oklahoma. However left to the county are evaluating property mailing billings taking in the levies.

Web The average cumulative sales tax rate in Tulsa Oklahoma is 831. 2020 rates included for use while preparing your income tax. Tulsa has parts of it located within Creek.

The total sales tax rate. Web The latest sales tax rate for Tulsa OK.

Best Places To Live In Tulsa Zip 74116 Oklahoma

Fort Worth Proposes Slightly Lower Property Tax Rate Wfaa Com

Property Taxes 101 Getting Past Some Of The Confusion Govt And Politics Tulsaworld Com

1531 W 46th St Tulsa Ok 74107 Realtor Com

Oklahoma Income Tax Calculator Smartasset

New Analysis Low Income Taxpayers In Oklahoma Pay More Than Twice The Tax Rate Paid By The Richest Oklahomans Oklahoma Policy Institute

Pros And Cons Of Living In Tulsa Ok Securcare Self Storage Blog

Tulsa Oklahoma Ok Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Owasso Oklahoma Business And Sales Tax Rates

/https://s3.amazonaws.com/lmbucket0/media/business/4DSR_Tulsa_OK_20220726222236_Ext_01.bcc146bb832cb4c03d349dbc8e7521eaabbbe420.jpg)

T Mobile Products At T Mobile S Olympia Ave Town Center Dr In Tulsa Ok

Taxes Broken Arrow Ok Economic Development

How Much Are You Getting Taxed Tax Brackets Explained

Obstetrician Gynecologist Ob Gyn Salary In Tulsa Ok Comparably

Pros And Cons Of Living In Tulsa Ok Securcare Self Storage Blog

Reasons To Move To Tulsa Oklahoma Movebuddha

Tulsa Real Estate Market Trends And Forecasts 2020

The True Costs Of The Tulsa Race Massacre 100 Years Later

6900 6952 S Lewis Ave Tulsa Ok 74136 Spectrum Shopping Center Loopnet

Lawmakers To Propose Legislation To End Oklahoma Grocery Tax Ktul

/https://s3.amazonaws.com/lmbucket0/media/business/3SJU_Tulsa_OK_20220921212929_Ext_01.8361d0fe01f01c1987e590fbad4e71a232365914.jpg)